The DroneShield Ltd (ASX: DRO) share price has come under pressure today after the company lodged a Change of Director’s Interest Notice revealing director share disposals. The defence technology firm confirmed that there is no undisclosed or material information behind the recent market movements and reaffirmed its full compliance with ASX disclosure obligations.

Key Highlights

- DroneShield confirmed it is not aware of any undisclosed material information that could explain recent share price volatility.

- A Change of Director’s Interest Notice was filed after market close on 12 November 2025, outlining director share sales.

- The company reaffirmed compliance with ASX Listing Rule 3.1 and continuous disclosure requirements.

- All disclosures were made in accordance with the board’s approved communication policy.

Market Context

The ASX issued a price query after DroneShield shares dropped sharply from $3.28 to $2.25 in a single session. The company responded that the market reaction appears linked to the disclosure of director share sales, rather than any new operational developments or business-related issues.

DroneShield reiterated that it remains committed to transparent, timely, and accurate communication with shareholders and regulators, reinforcing its adherence to strong corporate governance standards.

View Original Announcement on the ASX platform.

Outlook

The company has not announced any changes to its strategic direction or operational outlook, focusing instead on maintaining consistent disclosure practices and advancing its core business operations.

Investors can expect DroneShield to continue its emphasis on clear communication, regulatory compliance, and steady execution as trading stabilises.

DroneShield Share Performance

Over the past 12 months, DroneShield shares have surged 178%, significantly outperforming the S&P/ASX 200 Index (ASX: XJO), which gained around 7% during the same period.

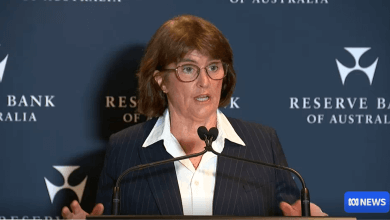

Also Read This: RBA Cuts Rates to 3.85%: Relief for Borrowers, Challenges for First-Time Buyers