Australia’s Rental ‘Crisis’: Smoke, Mirrors, and a Bit of Real Trouble

Despite viral footage of house-hunters queued like they’re chasing Taylor Swift tickets; Australia's rental market isn’t quite the catastrophe it’s made out to be—at least not for everyone. We dig into the data with real stats, and a solid look at what’s really going on.

Crisis? Depends on Who You Ask, Mate

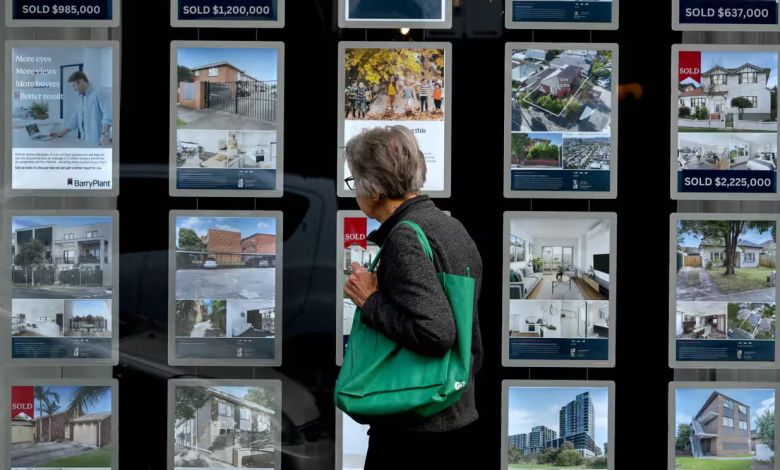

Picture this: 50 people lining up in their Sunday best for a two-bed rental like it’s a Bunnings sausage sizzle giveaway. Add stories of single parent’s couch-surfing and protestors waving “freeze the rents!” signs, and you’ve got what sounds like a full-blown housing apocalypse.

But as economist Ben Phillips and housing guru Michael Fotheringham point out, it’s not quite the end times—just a split-screen between perception and data.

Two Realities, One Market

| Rental Market Measure | Reported Increase (2019–2024) | Source | What It Means |

| Advertised Rents (New Listings) | +50% | CoreLogic | New rentals are pricey as heck—bad news for movers, newbies. |

| Actual Paid Rent (Ongoing Leases) | +19% | Australian Bureau of Statistics (ABS) | Most renters are paying far less than headlines suggest. |

| CPI (Inflation over same period) | +21% | ABS | Rent’s rise is below inflation—technically pulling CPI down, not pushing it up. |

| Rental Affordability (Rent/Income) | Dropped from 28% to 26% (since 2013) | Phillips’ analysis | Incomes have risen faster than rents overall, bucking the “crisis” narrative. |

| Severe Renter Stress (3+ issues) | ~21% of renters (2023) | HILDA Survey | High, but similar to the 15-year average. |

The Bathtub Analogy (Economics 101)

“A small flow of hot water (new rent listings) makes little difference to the much colder and larger stock of water in the bath (all ongoing leases).”

– Ben Phillips, ANU

Translation? Just because the new stuff is red-hot doesn’t mean everyone’s feeling the burn.

Expert Mic Drops

- Ben Phillips, economist and advisor to the Albanese government:

“The talk of a generalised rental crisis is overblown.”

- Michael Fotheringham, AHURI boss:

“We’ve been sleepwalking into this for 40 years… It won’t be fixed by Christmas.”

- CoreLogic vs ABS:

The CoreLogic data is “spicier” because it looks at new rentals. But the ABS covers 600,000 actual leases—making it far more representative of renters’ day-to-day reality.

Vacancy Rates: Where It Is Ugly

| Metric | Current Rate | Typical Rate |

| National Vacancy Rate | 1.0% | 2.5% |

| Duration Under 1.5% | 2 Years | Rare historically |

This tight vacancy rate is where the real pressure cooker lives—especially for those trying to move, start fresh, or escape mouldy share houses.

Who’s Really Copping It?

Struggling:

- Renters in high-demand metros (Sydney, Melbourne)

- Disaster-affected regions (e.g., Lismore)

- First-time renters, or those forced to move

Holding On:

- Long-term renters with stable leases

- Renters in lower-growth regional towns

- Households receiving government support (e.g., parenting payment, rental assistance)

So What’s Broken?

It’s not an overnight disaster—it’s a slow-moving policy fail decades in the making.

“We need long, slow, multifaceted programs,” says Fotheringham. “This isn’t a cyclone. It’s chronic neglect.”

Translation: No magic wands. No rent freeze fairytales. Just a massive renovation job ahead.

Rental Stress Isn’t New—Or Unusually Bad

| Year | % of Renters Reporting 3+ Financial Stresses |

| 2021 | 17% |

| 2023 | 21% |

| 15-Year Avg | ~20% |

Source: HILDA Survey via The Guardian

Bottom Line from Down Under

Yes, there’s rental pain. But no, it’s not a “crisis” for everyone. The debate’s been hijacked by the shock value of steeply advertised rents—but long-term data shows a slower, more nuanced burn.

If you’re a renter stuck in the open market, it’s grim. But if you’re one of the 3 million Aussie households with a lease already locked in, your rent has risen less than inflation.

So is the system stuffed? Definitely. Is it in meltdown? Not quite.